As our life’s journey takes us down unexplored paths (a new job, a marriage, a lifestyle change), we may find ourselves living in a new state. Interestingly, COVID-19 has prompted us to reconsider the connection between where we work and where we live. Though the global pandemic challenged us in many ways, it also opened opportunities to explore working remotely. As a result, you may already enjoy living in one state while working in another or simply thinking about the possibilities.

Relocating to your new home state can have many financial implications. To help plan your financial future, you should consider your stage of life, income, wealth, RSUs, and the status of your primary residence. In addition to these items, there are many other factors to examine, and a licensed financial planner can walk you through what’s essential for your situation.

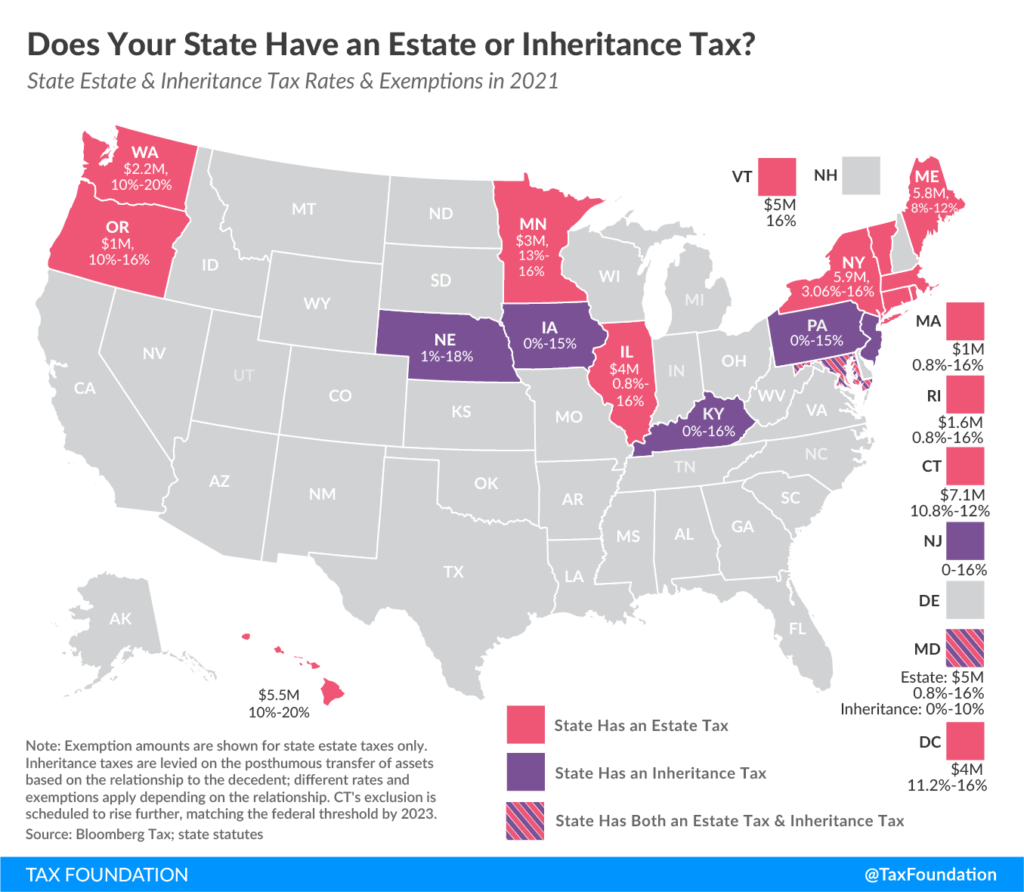

Source: Tax Foundation. February 24, 2021. Does Your State Have an Estate or Inheritance Tax? Written by: Janelle Camenga Retrieved June 22, 2021, from https://taxfoundation.org/state-estate-tax-state-inheritance-tax-2021/

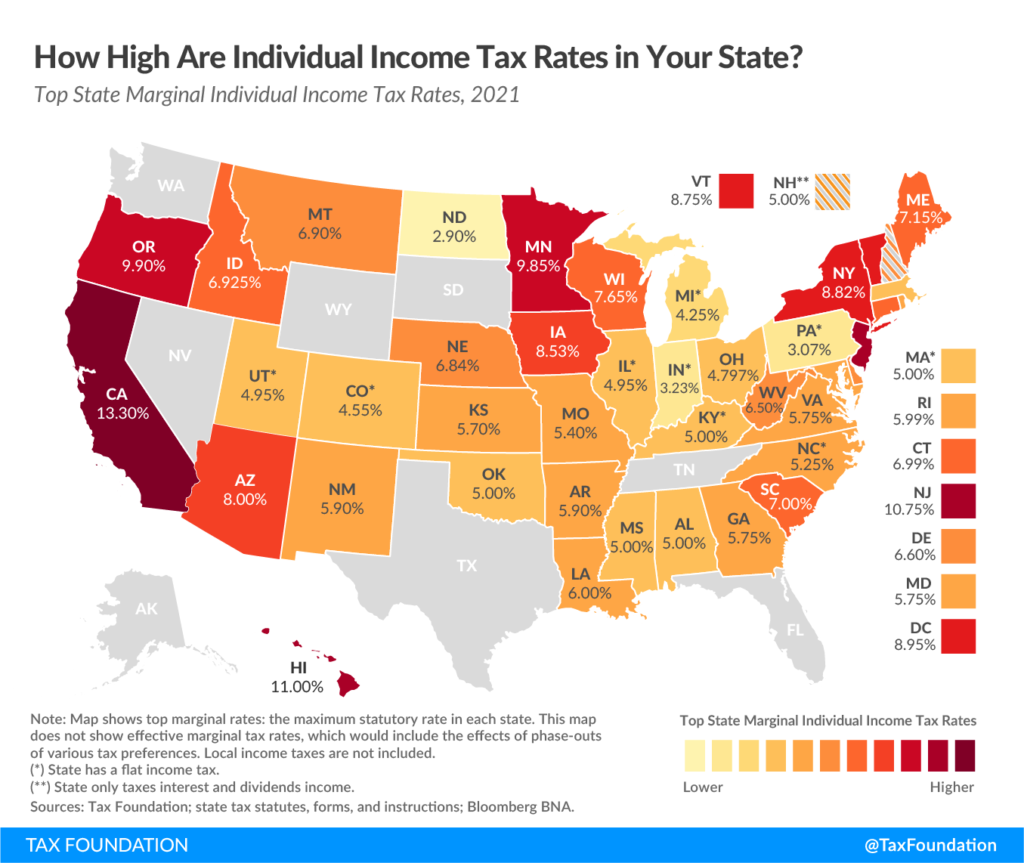

If your plans include retiring to another state, you should be aware that thirteen states tax social security benefits, and eight states have no income tax that retirees need to consider for their cost of living. Some states don’t tax certain pensions. However, if you’ve accumulated a significant amount of wealth, you’ll need to pay a federal estate tax with a top rate of 40%. In addition, twelve states and the District of Columbia impose state estate taxes, and six impose inheritance taxes. Younger and mid-career individuals working at a tech firm with lucrative option grants and RSU packages may need to consider the timing of their move and any hangovers for taxes that may be due to California years after you’ve left the Golden State.

Source: Tax Foundation. February 17, 2021. State Individual Income Tax Rates and Brackets for 2021. Written by: Katherine Loughead. Retrieved June 22, 2021, from https://taxfoundation.org/state-income-tax-rates-2021/

Additionally, do you currently have embedded gains in your real estate portfolio? Or, do you have muni bonds in your current portfolio? If you’re selling a residence, will delaying your move another month or two allow you to get your total gain exclusion of up to $500,000 per married couple on the sale of your primary residence?

There are many things to consider, and this blog only touches on a few. With early planning, a professional financial planner can help you avoid many pitfalls and enjoy the experience of moving to another state.

Ready to start planning for a brighter future? Call today at (408) 840-4030, or contact our team online.