Who We are

Our primary goal is to help our clients consider all of their possibilities and take the successes they’ve already achieved even farther. In order to do this effectively, when we first begin a new client relationship, we must first understand what is most important to the client. We then build a detailed personal financial profile, set appropriate financial, lifestyle, and work-optional goals that reflect what the clients are trying to achieve, and we also determine what milestones the clients wish to reach along the way. We then develop, refine and activate a focused, long-term financial plan designed to help span that unique distance. Below, you’ll find the steps we follow when we help clients take the success they’ve achieved even farther.

Understand

When we start a relationship with a new client, it is imperative that we understand what is important to them. This is where we start. We need to understand what our clients are trying to achieve before any recommendations are made. This stage is all about learning about the clients’ financial, lifestyle, or work-optional goals.

Discover

Once we understand the goals that are important to our new client, we then build an extremely thorough personal financial profile on them. This ‘deep dive’ on their financial situation gives us a complete understanding of our clients’ current circumstances, so we can be precise about our recommendations.

Implement

Once we understand what the client wants to achieve, and after we’ve built a personal financial profile, we are now ready to implement. A comprehensive financial plan is put into place and shared with the client. Typically, we share a few different scenarios with the client at this stage and final adjustments are made before officially beginning implementation.

Navigate

As we begin implementation, Concentrum will continually update the plan, as necessary, based on market conditions, government policy changes, or any circumstance that might necessitate a change in the plan. Clients will receive a Personal Financial Organizer that will track any changes that are made, so that they can always see exactly where they are on the journey to achieve their goals.

Resources

blog and news

What kind of things are making us go hmmmm? Check out our Blog where you can find ongoing musings from Jeff, Jay and Glenn, as well as what’s going on at Concentrum and in the News.

Capabilities diagram

Our capabilities include investment, holdings, trusts, upcoming life events, early or late retirement planning, Wills and so much more.

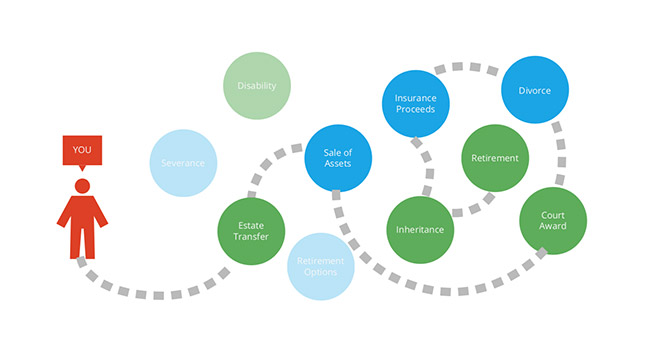

Your Path to Financial Planning

Financial planning is the process of planning for or reacting to critical financial events. Your life will have its own pattern of critical financial events.

Our Journey to Independence

Hear from our founders, Jay and Jeff Fong, and see why they made the choice to start up their own firm to help families and companies like yours.

Total Wealth Management

Concentrum’s Wealth Management service isn’t just about your investments. It’s about your life, your goals, your vision, and your future. Concentrum Wealth takes great pride in the long-term relationships we build with our clients. When we form a new client partnership, we take the time to learn about all the aspects of your life that affect, or are affected by, the management of your assets.

“We are faithful to a simple, yet powerful philosophy: Build long-term relationships with your clients that are based on trust.”

– Jeff and Jay Fong,

Founders of Concentrum Wealth Management