When you started your career, you probably had plenty of questions about saving for retirement through your company 401K/IRA. How much should I contribute? Can I contribute? How should I allocate my investments? Which types of options are available from my employer? Or outside my employer? A common question many people have when considering their goals is whether they will have enough money for retirement. Let’s say you’re ready to retire, and you’ve amassed a nice nest egg in your retirement accounts—but what is it really worth?

In many cases, one of the primary buckets one accumulates over their working career is their 401K. Most often, your 401K dollars are pre-tax, and you’ve received the tax deduction when you made the contribution. Eventually, when you take a distribution from your 401K or IRA Rollover, those dollars will get taxed as ordinary income as funds are disbursed from your accounts.

One of the most common misperceptions is that you’ll be in a SIGNIFICANTLY lower tax bracket in retirement as compared to when you are in your full-time working years. This may be true for some individuals; however, it is rare to see someone moving from one of the top brackets into one of the lowest two tax brackets during retirement.

Another common misunderstanding is regarding Required Minimum Distribution (RMD). With the ratification of The SECURE ACT, the RMD age changed to 72. That means regardless of whether you need the money or not, the IRS requires you to take out a “minimum” amount once you reach this age.

For example, let’s assume you are 50 years old and have been diligently saving in your 401K for 25 years. You’ve amassed $1 Million in your 401K balance and plan to max out your 401K for the next ten years ($26,000) before retiring at 60. Assuming you have a 7% return at age 72, your account value could be over $5.2 Million. Whether you need the income or not, your projected RMD would be $204,666.

At age 72, you’ll need to withdraw the $204,666 as ordinary income. From a tax liability standpoint, this income doesn’t factor in marital status, income from social security, or other income sources such as rental income. If those elements are included, you (and maybe your spouse) would not be in the lower tax brackets?

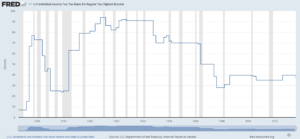

We are currently at historically low tax rates (see below). Stimulus spending by the federal government in 2020 to support the economy and the American people have sent the federal deficit and national debt to all-time highs. Additionally, the current reduced individual tax rates that went into effect in 2017 are scheduled to revert to the original higher tax rates in 2025, if not sooner.

Source: FRED Economic Data. January 14, 2021. U.S. Individual Income Tax: Tax Rates for Regular Tax: Highest Bracket. Retrieved January 29, 2021, from https://fred.stlouisfed.org/series/IITTRHB

So, is your 401K really worth what the balance reflects after taxes? From a planning perspective, are you taking advantage of all the different buckets your company 401K offers? Do you understand how those buckets could help in your retirement success?

Planning for retirement involves putting a plan in place that balances the tax benefits received today and the future. To see what your projected RMD might be in the future, enter your information in our RMD Calculator. If you have questions about optimizing all the benefits in your company 401K plan or you’re a small business owner who needs help designing a plan to fit your needs, please contact us for an appointment.

Ready to start planning for a brighter future? Call today at (408) 840-4030, or contact our team online.